Table of Content

- What Is The Current Interest Rate On An Fha Mortgage

- Example Mortgages On A 1 Million Dollar Home

- Lump-Sum Payout and Annuity Payout Calculator for Megamillions, Powerball, Lotto, and Lottery Winnings

- How to Afford a Million Dollar Home

- How to pay off a 15-year mortgage in 7 years

- Guide on $1 million dollar mortgage monthly payment calculator

As you might expect, jumbo loans generally have stricter criteria than conventional and government-backed mortgages. As a general rule, your mortgage payment shouldn’t exceed one-third of your monthly income. Your specific monthly payment would be based on exactly how much you borrow to buy your $1 million property, as well as the interest rate and term for your loan. If you’re thinking about buying a house or another property, then yes—you probably need this kind of loan! But if you don’t have any plans to buy real estate anytime soon , then it doesn’t matter how much money is available to borrow right now.

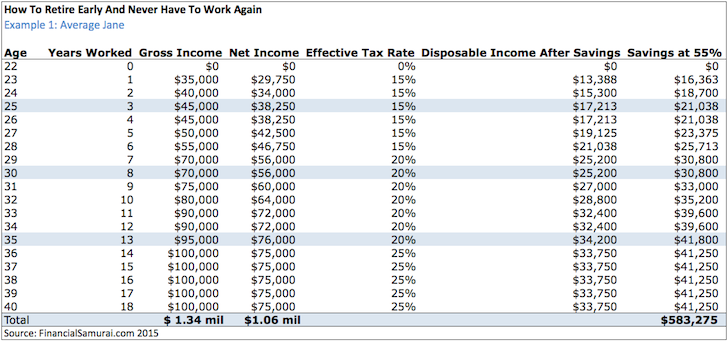

This is typically required when you are arranging a mortgage, or figuring out how much it will cost on a monthly basis based on the payments you’ll be making. It’s very easy to work out a monthly payment using a mortgage calculator…. This mortgage calculator will help you figure out how much house you can afford based on your salary, down payment, and debts. It also accounts for other factors, like your mortgage interest rate and estimated property taxes and homeowners insurance costs. A typical borrower should expect to pay around $5,258 in monthly mortgage payments on a million-dollar house, assuming they put 20% down and have an excellent credit score (750+). Many lenders require that jumbo loan applicants have the equivalent of 6-12 months of mortgage payments in savings — roughly $31,548–$63,096 for a $1 million home.

What Is The Current Interest Rate On An Fha Mortgage

Plug in different numbers and scenarios, and you can see how your decisions can affect what you’ll pay for a home. The house you have wanted so much has a monetary value of $1,000,000. If despite the price, you want to get it anyway and you do not have enough liquidity to acquire it, the most sensible thing to do is to apply for a mortgage loan.

All in, you could pay $1,000 per month in taxes and insurance, a sizeable bill above and beyond the principal and interest payment. Chances are, in your happy financial position, you’ve paid down most of your total debt, so we’ll return that number to $250 in monthly debt repayment. PMI protects your lender in case you default on your loan, so rates could be higher if your credit score or history categorize you as a risky borrower.

Example Mortgages On A 1 Million Dollar Home

In employing this strategy, borrowers can shorten the term, typically resulting in a lower interest rate. However, this usually imposes a larger monthly payment on the borrower. Also, a borrower will likely need to pay closing costs and fees when they refinance. Make extra payments—This is simply an extra payment over and above the monthly payment. On typical long-term mortgage loans, a very big portion of the earlier payments will go towards paying down interest rather than the principal. Any extra payments will decrease the loan balance, thereby decreasing interest and allowing the borrower to pay off the loan earlier in the long run.

Lottery Payout Calculator is a tool for calculating lump sum payout and annuity payout by choosing your lottery numbers in each state. Lottery Payout Calculator provides Lump-Sum and Annuity Payout for Megamillions, Powerball, Lotto. Although there is no set time frame, the custom within the real estate industry is that mortgage pre-approval is valid for between 90 to 180 days. Make sure to ask your lender how long your pre-approval lasts, or look for this expiration date on your pre-approval letter. As you can see, the income to afford a $2-million home and the income needed for a $3-million home are quite high. This is because at these prices, even with a 20% down payment, your mortgage will be very large.

Lump-Sum Payout and Annuity Payout Calculator for Megamillions, Powerball, Lotto, and Lottery Winnings

A tough decision many homeowners face is to either pay off the mortgage early, or invest. They might decide to invest more towards stocks, bonds, mutual funds, or towards your retirement savings. Keep reading to determine if your salary is high enough to afford a million-dollar home.

To calculate how much you'll get if you opt for a lump sum payout, look at what you've won, subtract taxes and figure out how many times your annual income is. A bi-weekly mortgage is a mortgage in which the borrower makes half of their monthly mortgage payment every two weeks, rather than paying the full payment amount once every month. So if you paid monthly and your monthly mortgage payment was $1,000, then for a year you would make 12 payments of $1,000 each, for a total of $12,000. But with a bi-weekly mortgage, you would make 26 payments of $500 each, for a total of $13,000 for the year. This can help the borrower pay off their mortgage loan sooner and reduces the total amount of interest paid over the life of the loan. Lengthen the term of your loan.Choose a longer time period to pay off your mortgage, like 30 years rather than 15.

How to Afford a Million Dollar Home

If you’re hoping to buy a home, weeks or months could pass before you find a house and negotiate your way to an accepted offer. But mortgage pre-approval does not last indefinitely, since your financial circumstances could change by the time you close your real estate deal. As such, you’ll want to know how long pre-approval lasts before it expires. A mortgage is a loan to help you cover the cost of buying a home. It provides a general estimate of possible mortgage payment and/or closing cost amounts and is provided for preliminary informational purposes only. Your own mortgage payment and closing cost amounts will likely differ based on your own circumstances.

But lets say a borrower has a credit score on the lower end of the approvable range. The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve.

The study looked at the average number of years the homeowner lived in the home, negative equity, days on market and a few more indicators. You can think about refinancing or shop around for other loan offers to make sure youre getting the lowest interest rate possible. Personal satisfaction—The feeling of emotional well-being that can come with freedom from debt obligations. A debt-free status also empowers borrowers to spend and invest in other areas.

Your use of this tool is subject to our Terms of Use and Privacy Policy. That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youâll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off. The credit score needed for a conforming loan starts at 620, but lenders will probably require even higher credit scores for jumbo loans. If you have that type of money somewhere, figure out how many months of mortgage payments it would cover.

If your score is low, you should consider researching how to build business credit.Collateral. Depending on the type of loan, you may be asked to provide some form of collateral, such as equipment or inventory.Business financial statements. Loan officers will also review your business financials to make sure that you have the necessary income to qualify for a loan. Penalty amounts are usually expressed as a percent of the outstanding balance at the time of prepayment or a specified number of months of interest. The penalty amount typically decreases with time until it phases out eventually, normally within 5 years. One-time payoff due to home selling is normally exempt from a prepayment penalty.

In exchange, the insurance company would start issuing you payments at age 65 and continue issuing payments each month for your lifetime. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. If you have a net worth of over a million dollars, you might be in a position to purchase a million-dollar home outright.

You may not qualify with any lenders if your monthly mortgage payment surpasses 28% of your income. Based on how much should you spend on your mortgage, your monthly payment could only be $469 per month. You would need a considerably high down payment saved or a very cheap home for around $60,000. To afford a $1 million home you need a minimum annual income of $200,000 to $225,000. You'll also need to have enough money saved for the down payment and closing costs, which can add up to over 20% of the purchase price. It's essential to consider two factors when calculating how much money a winner will receive from a lottery win—the payout and whether you want an annuity payout.

No comments:

Post a Comment