Table of Content

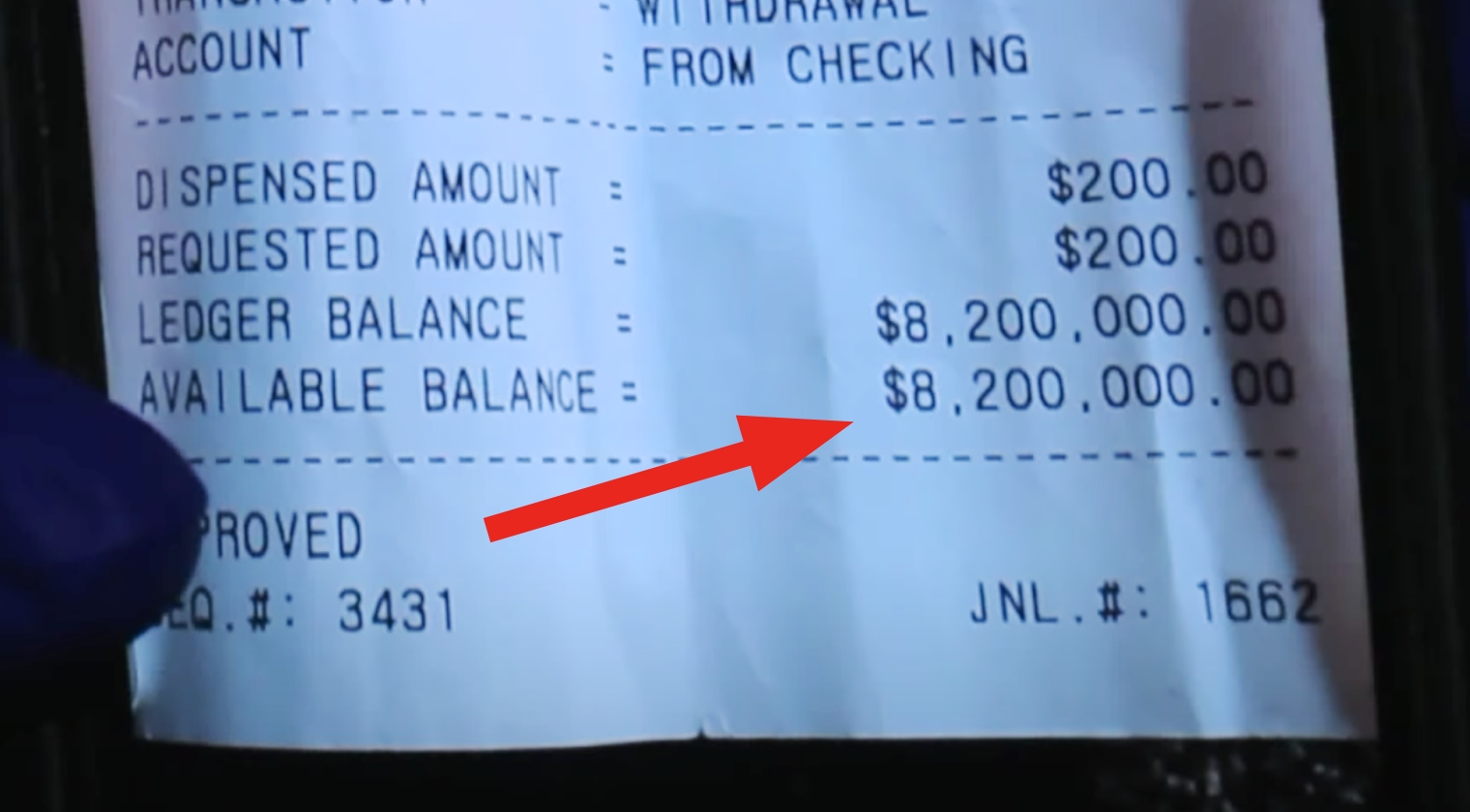

By 2001, the homeownership rate had reached a record level of 68.1%. The number of U.S. homes worth more than $1 million nearly doubled since before the pandemic, to 8.2% in February from 4.8% in February of 2020, according to Redfin. If you make $100,000 per year, your hourly salary would be $51.28. This result is obtained by multiplying your base salary by the amount of hours, week, and months you work in a year, assuming you work 37.5 hours a week.

Assuming you have a sufficient credit score, what would you need to make to meet a 32% debt to service ratio? A mortgage term is the length of time you have to repay your mortgage loan. If your mortgage pre-approval is set to expire before you’ve completed the home-buying process, this does not mean you have to start the pre-approval application process from square one. Mortgage pre-approval is a statement from a lender who’s thoroughly reviewed your finances and decided to offer you a home loan up to a certain amount. Pre-approval is a smart step to take before making an offer on a home, because it will give you a clear idea of how much money you can borrow to pay for a house. Pre-approval is also a great way for you to stand out from other buyers in a competitive marketplace, since it proves to sellers that you can follow through on your offer and close the deal.

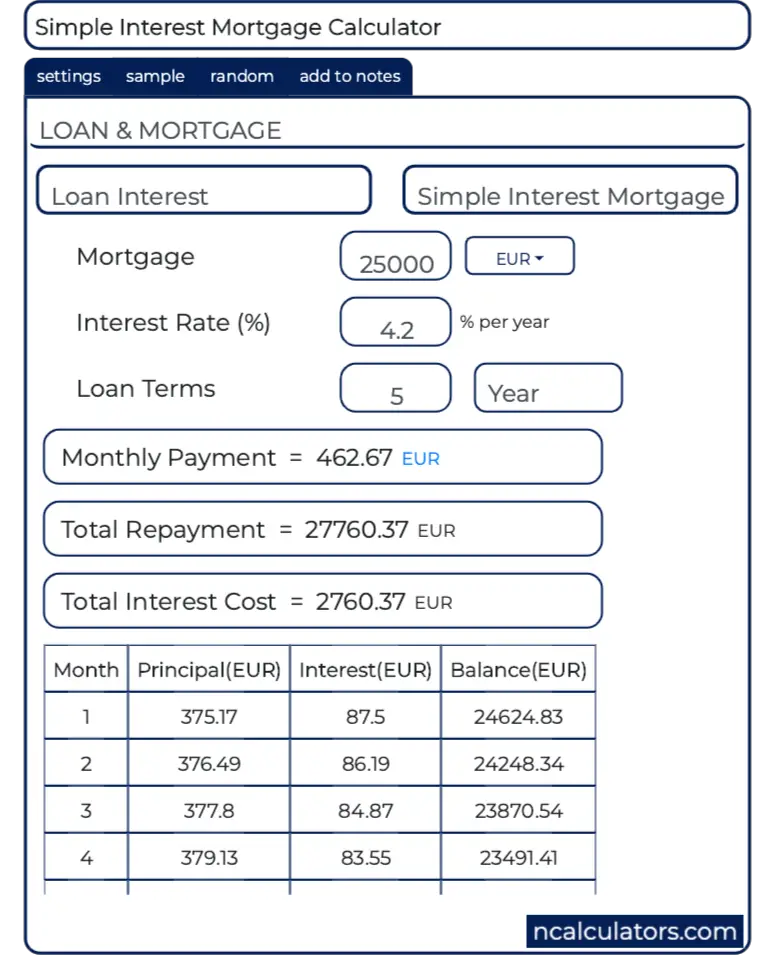

Your total interest on a $1,000,000.00 mortgage

These banks and brands are not responsible for ensuring that comments are answered or accurate. Amortization means that at the beginning of your loan, a big percentage of your payment is applied to interest. With each subsequent payment, you pay more toward your balance.

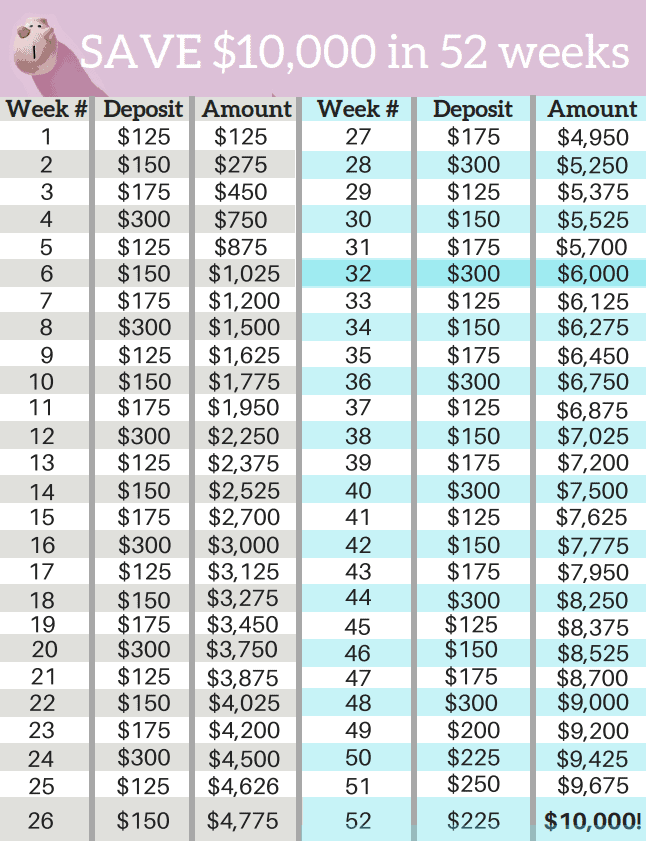

There are two ways that you can get your lottery payout in on your winnings, a lump sum payout, and an annuity payout. It is where annual payments of your winnings are sent to you over several years. The choice between a lump sum payout and an annuity payout is yours—and there are benefits to both approaches! First, you need to know about calculating lottery lump sum or annuity payouts.

What income do you need for a $800000 mortgage?

If you put less than 20% down on your home, your lender will likely require you to purchase private mortgage insurance , which could cost 0.3%–1.15% of the loan amount annually. It's usually a good idea to pay down high-interest consumer debt before saving for a down payment and applying for a mortgage. Not only will it help you afford a larger house payment, but it may also raise your credit score — potentially letting you secure a lower interest rate on your mortgage. Your mortgage will likely qualify as a "jumbo loan," meaning it exceeds the maximum "conforming" loan limit in your area. The limit is typically $510,400 but extends to $765,600 in some high-cost markets.

A median selling price of over $1.3 million lands San Fran in the top spot on our list. You might think real estate is not a bad place to have $1 million invested. Indeed, home price appreciation averaged 15% throughout 2021 according to CoreLogic. In short, keeping a large, expensive home well maintained isn’t cheap. But a larger home costs more to replace if it is destroyed by fire or another disaster. Naturally, the insurance company will charge more for greater risk.

How much income do you need to buy a $600000 house?

These are the steps to afford a million dollar home and the mortgage calculations to find out what you can afford. The earnings on Roth contributions are qualified (i.e., paid tax-free) when withdrawn if five years have passed since Jan. 1. This planimeter tool can be used to measure the enclosed area of a defined polyline on a map. Unfortunately, due to a large price increase in back-end services, we can no longer offer some features on this page.

There are a number of ways you can source funds for a mortgage down payment. Traditional sources include saving a fixed amount from every paycheque, selling stocks, bonds or personal property, or reaching out to immediate family, for example. Another great option is the RRSP Home Buyers’ Plan which lets first-time homebuyers withdraw up to $35,000 from Registered Retirement Savings Plans for a home purchase, tax-free.

How much income do you need to buy a $650000 house?

Your interest rate is applied to your balance, and as you pay down your balance, the amount you pay in interest changes. On a 30-year $1,000,000.00 mortgage with a 7.00% fixed interest rate, you may pay $1,395,088.98 in interest over the life of your loan. Fill out the form and click on “Calculate” to see yourestimated monthly payment.

Capital locked up in the house—Money put into the house is cash that the borrower cannot spend elsewhere. This may ultimately force a borrower to take out an additional loan if an unexpected need for cash arises. Other costs—includes utilities, home maintenance costs, and anything pertaining to the general upkeep of the property.

If you’re purchasing with an FHA loan that requires a 3.5%-10% down payment, your score must be 580, as well as any VA loans. Certain lenders with higher interest rates may accept your application with a score as low as 500. For that, you need to first find out the mortgage payment for a $1 million home, then you will understand how much income is necessary to be approved to buy your dream home . Your home loans principal and interest are not the only things to pay for on a home. You will have to pay for property taxes, homeowners insurance, and if applicable HOA dues, supplemental taxes like Mello Roos, or taxes for local schools.

You don’t necessarily receive back the principal on the account. This functions more like a return on a traditional investment product rather than the debt-style structure of an annuity. If you buy a $1 million annuity, you will receive monthly payments for a period of time. How much you receive, and for how long, depends entirely on the individual contract you buy, when you buy it and who you buy it from. For example, say you buy a lifetime annuity that will start to pay you at age 65.

A 30-year, $1,000,000 mortgage with a 4% interest rate costs about $4,774 per month and you could end up paying over $700,000 in interest over the life of the loan. When youre taking out a jumbo loan, a small difference in your interest rate can mean a difference of tens of thousands of dollars over the life of your mortgage. Its worth your time and effort to shop around for the best mortgage rate. Your lender may require that you get mortgage loan insurance, even if you have a 20% down payment. Thats usually the case if youre self-employed or have a poor credit history.

These two examples are the typical baseline estimation of a mortgage for a million-dollar home. If you can afford a larger down payment, have a higher annual income, and a better financial record, you will likely make lower monthly payments and get more flexible interest rates. You can count on the lender being a bit stricter than they would with a non-jumbo loan. We are talking about a million-dollar home here, so they have to cover their bases. Lets use the standard conventional guidelines for informational purposes.

If you’re hoping to buy a home, weeks or months could pass before you find a house and negotiate your way to an accepted offer. But mortgage pre-approval does not last indefinitely, since your financial circumstances could change by the time you close your real estate deal. As such, you’ll want to know how long pre-approval lasts before it expires. A mortgage is a loan to help you cover the cost of buying a home. It provides a general estimate of possible mortgage payment and/or closing cost amounts and is provided for preliminary informational purposes only. Your own mortgage payment and closing cost amounts will likely differ based on your own circumstances.

There’s no magic formula that says you need X income to afford a $1 million house. While a palatial country estate might not be subject to any HOA regulations, a house in a luxury neighborhood could require residents to pony up $1,000 or more in fees every month. Most personal finance experts recommend setting aside 1%–4% of your home's value annually to cover the cost of maintenance and repairs. That equates to as much as $40,000 for a million-dollar home, not including the price of any additional renovation projects you plan to undertake. Property taxes are levied and collected at the local level, typically by your city or county government — and sometimes both.

No comments:

Post a Comment